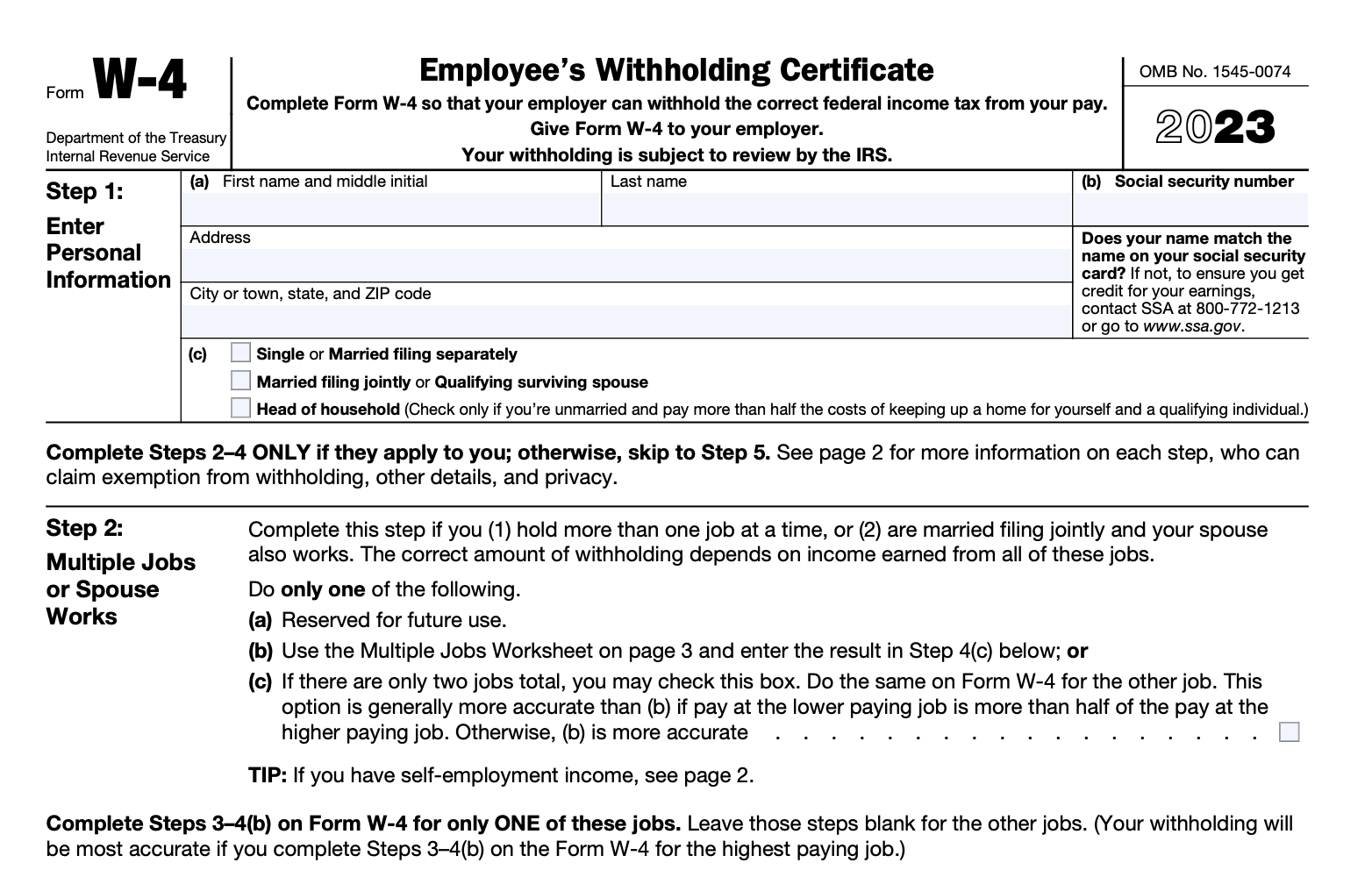

W4 Form 2024 Instructions 2024. Irs makes minor changes to 2024 form, allowances still out. What it is, what changes.

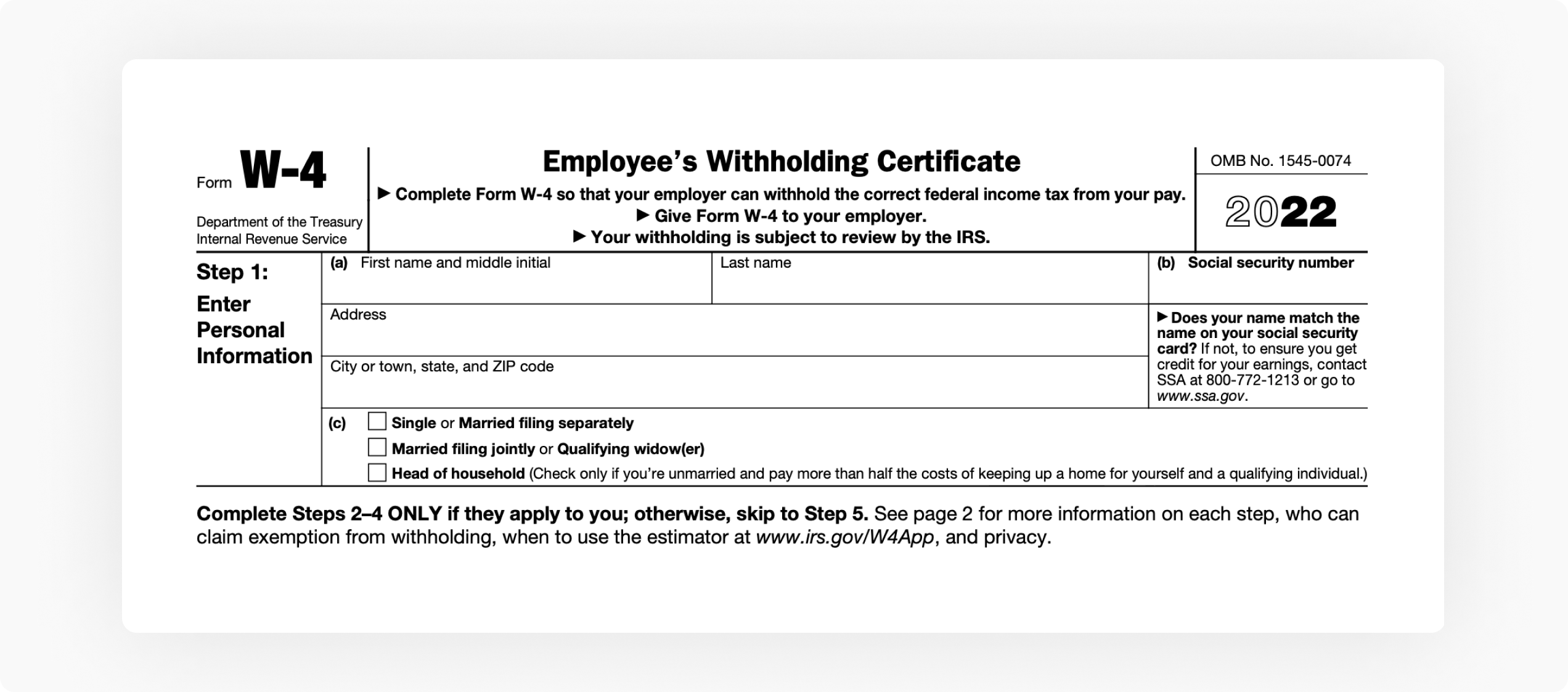

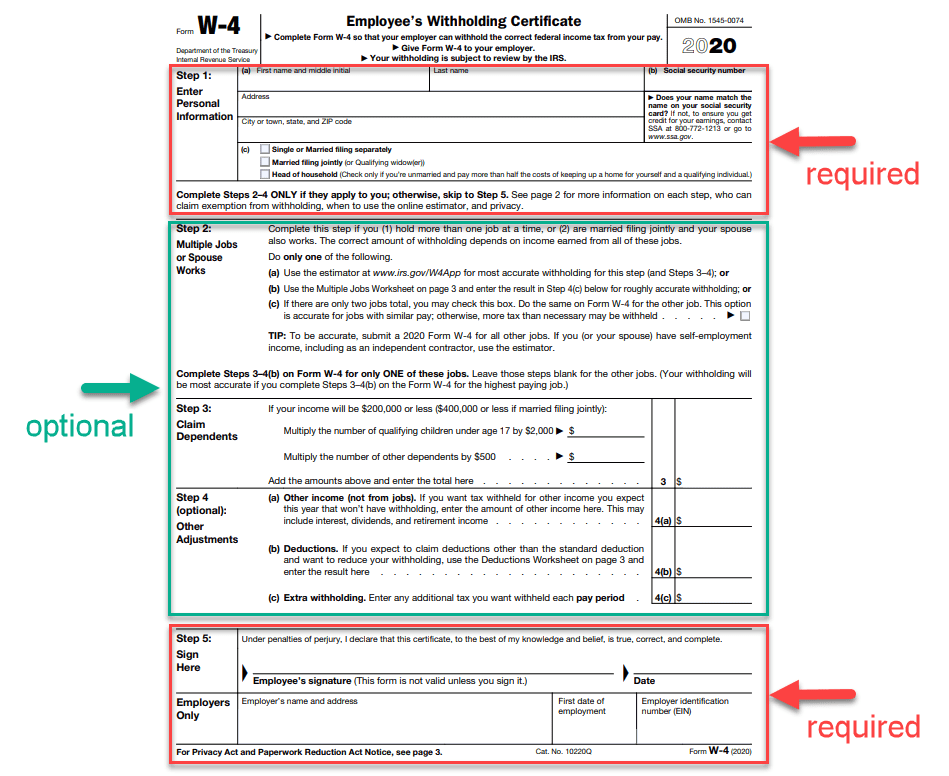

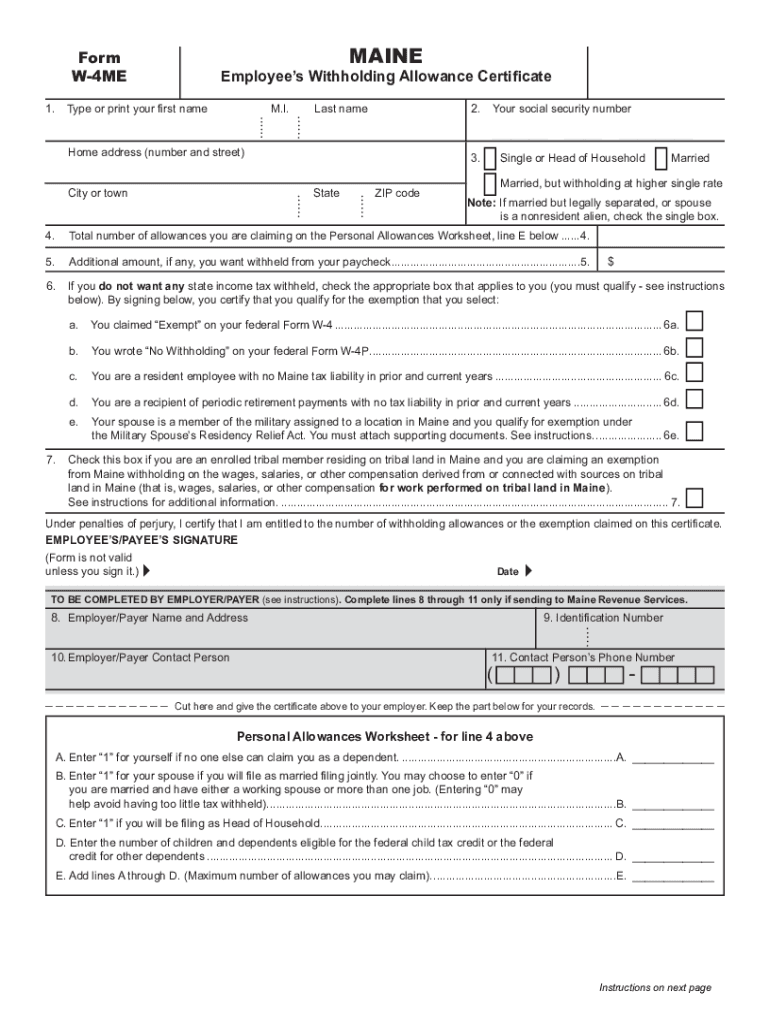

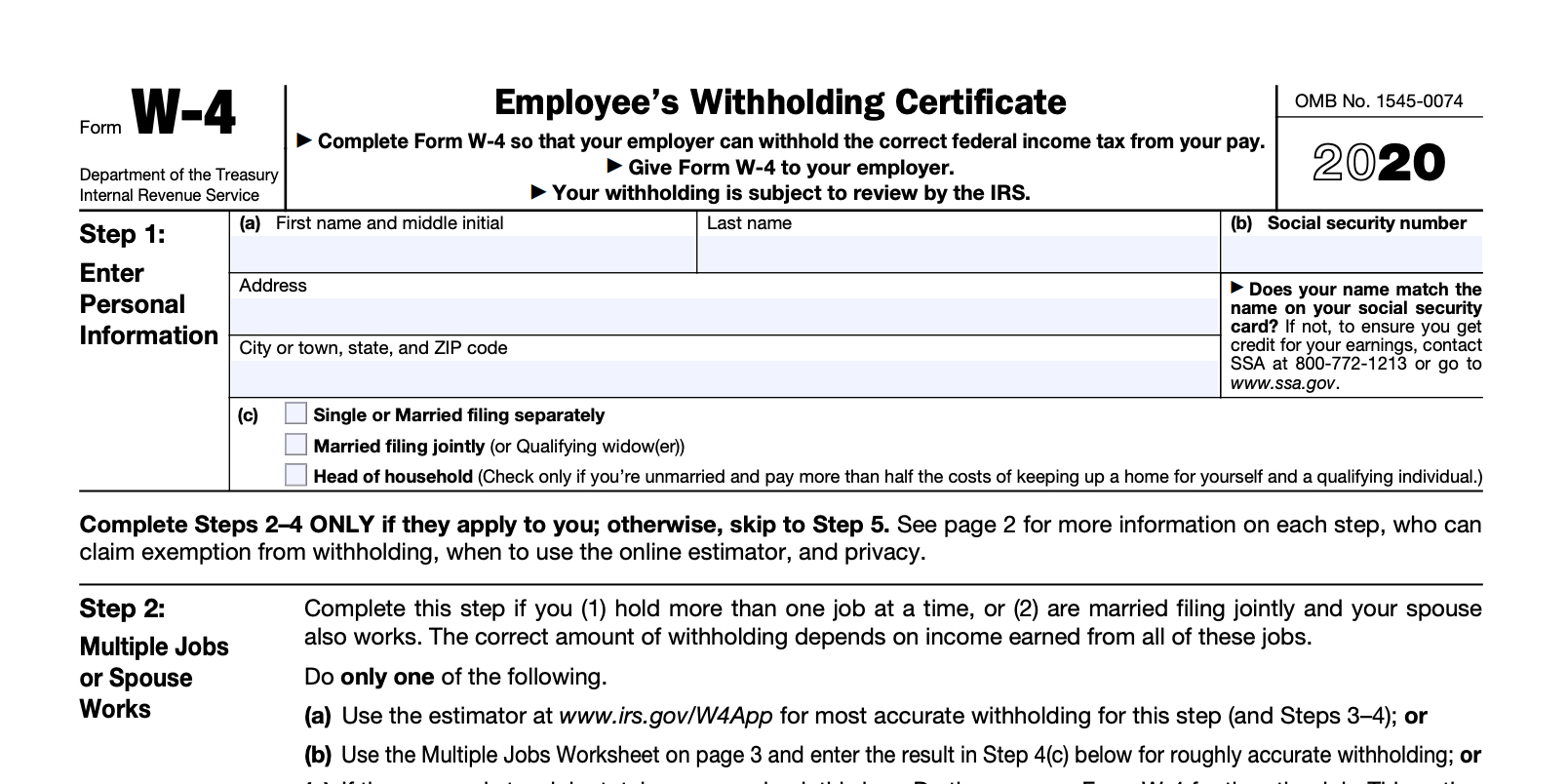

This initial section remains straightforward, requiring your basic personal information, including your filing status. Employee’s illinois withholding allowance certificate and instructions.

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, For example, if you plan to make $40,000. Irs makes minor changes to 2024 form, allowances still out.

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, I9 forms 2021 printable fillable calendar printables free blank,. What it is, what changes.

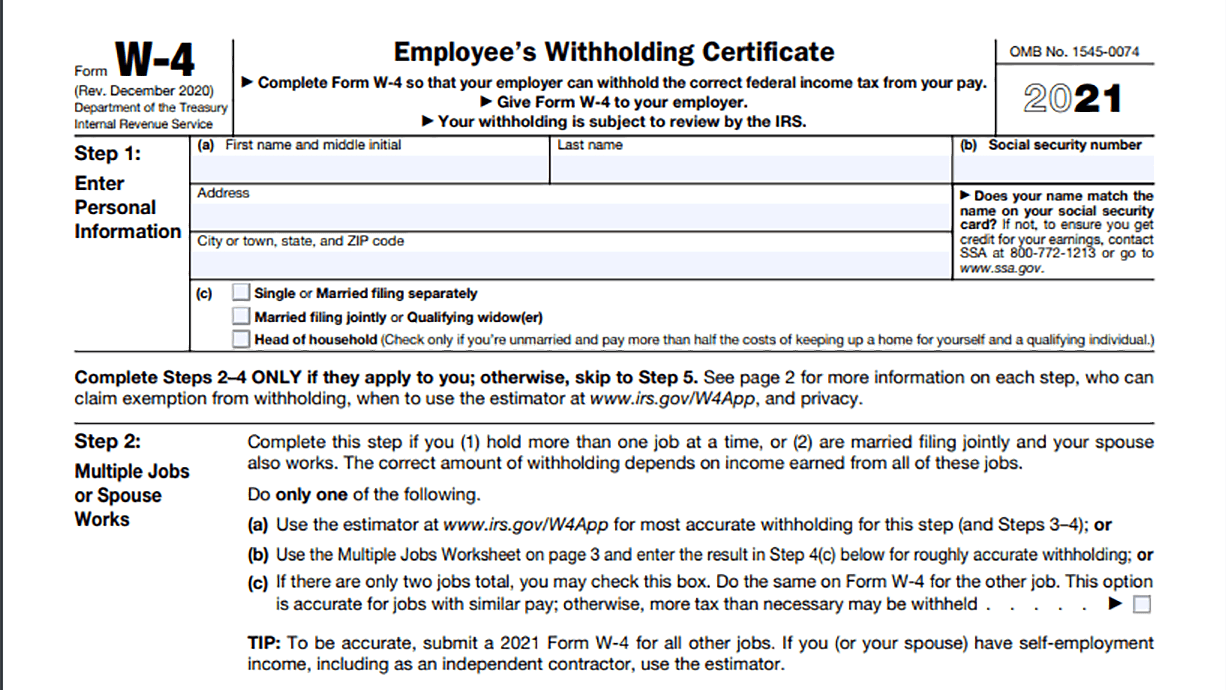

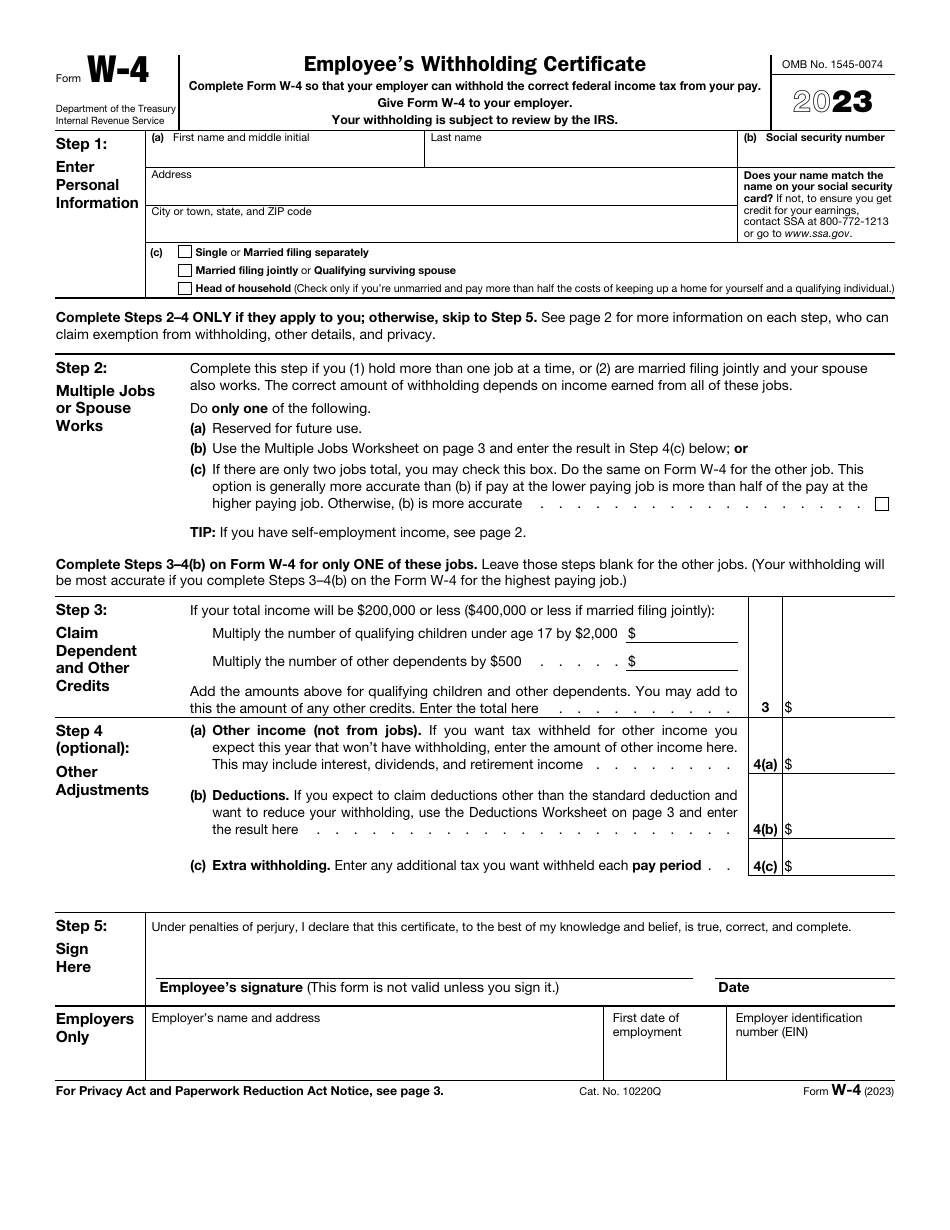

W4 Form Instructions to File 2024 W4 Forms, W4 tax withholding steps 2 to 4 explained | 2024 | money instructor. Form used to apply for a refund of the amount of tax withheld on the 2024 sale or transfer of maryland real property interests by a nonresident individual or nonresident entity which is.

What Is the W4 Form and How Do You Fill It Out? Simple Guide SmartAsset, What it is, what changes. I9 forms 2021 printable fillable calendar printables free blank,.

IRS Form W4 Download Fillable PDF or Fill Online Employee's, W4 tax withholding steps 2 to 4 explained | 2024 | money instructor. Employee’s illinois withholding allowance certificate and instructions.

W4 Form Employee's Withholding Certificate Instructions pdfFiller Blog, Employee’s illinois withholding allowance certificate and instructions. December 28, 2023 | read time:

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Updated for 2023 (and the taxes you do in 2024), simply enter your tax. Instructions for using the irs’s tax withholding estimator when figuring.

W4 20232024 Form Fill Out and Sign Printable PDF Template airSlate, You need to fill in your name, address, social security number, and filing status. Irs makes minor changes to 2024 form, allowances still out.

W4 Form Printable 2024 Darell Blancha, What it is, what changes. Tax forms are tax year specific.

Ihss W4 Form 2024 Cordy Dominga, Any altering of a form to change a tax year or any reported tax period outside of the stated year of the. If you do not complete this certificate, then your employer will calculate your colorado.